Services

About Mphasis

INSURANCE/FINANCIAL SERVICES

Industry: Insurance/Financial Services

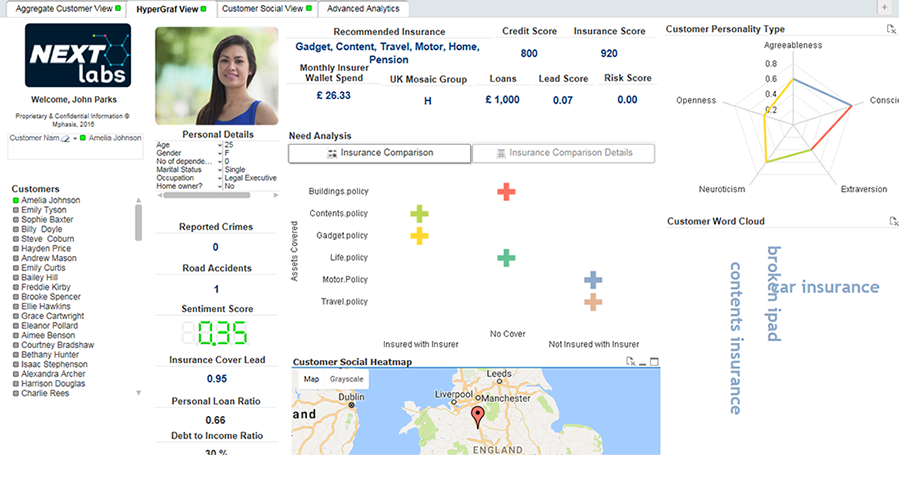

Overview: Identify cross-sell and up-sell opportunities in Insurance Domain

With the availability of customer data generated from multiple digital touch points, organizations are now poised better than ever to provide cross-sell (related products) and up-sell (higher value products) recommendations to their customers. Predictive analytics and machine learning driven cross-sell and up-sell opportunity identification can help organizations reduce acquisition costs, increase customer lifetime value, and increase wallet share. HyperGraf™ allows Insurance companies to gain significant insights and provide a customer 360 view by tapping into multiple data sources ranging from demographic, financial, insurance, competitor along with social data.

Enterprise Challenges

HyperGraf™ Solution

Outcome