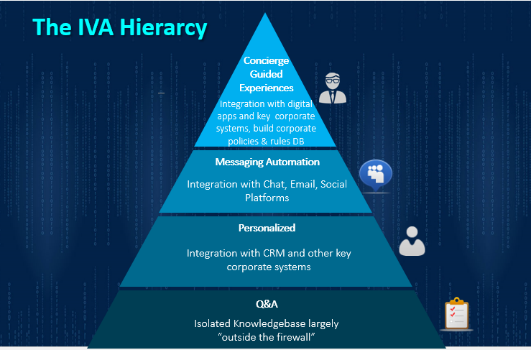

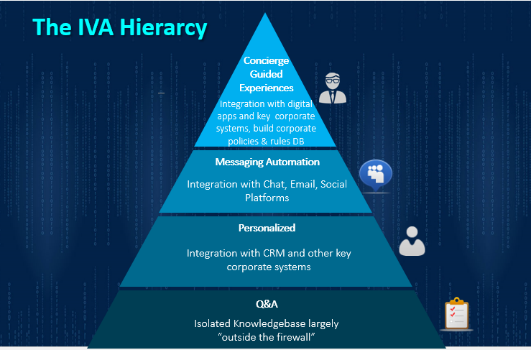

One of the interesting trends I see firsthand is how artificial intelligence (AI) is being used to take user experience to its next logical level of progression: from pointed data to the contextual conversation. What is most interesting is the ability of the Intelligent Virtual Agent (IVA) to bring together neuro-linguistic programming (NLP), AI, the repository of data, and on the job learning to make the engagement not only contextually relevant but also potentially value – adding. At the back end, the company behind the IVA recognizes host of benefits including decreased reliance on the call center and the ability to harness and use data from silos in a typical micro engagement to uncover opportunities to upsell. Customers also clearly benefit in being able to make more informed, context relevant decisions. The benefits fall into 4 buckets: Branding, better customer experience, increased business revenues, and reduced cost derived from operational efficiencies.

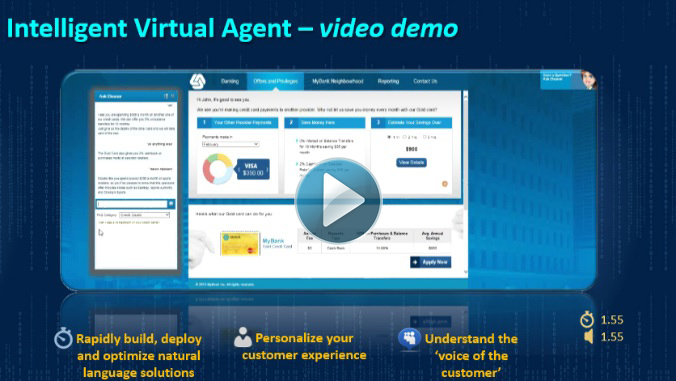

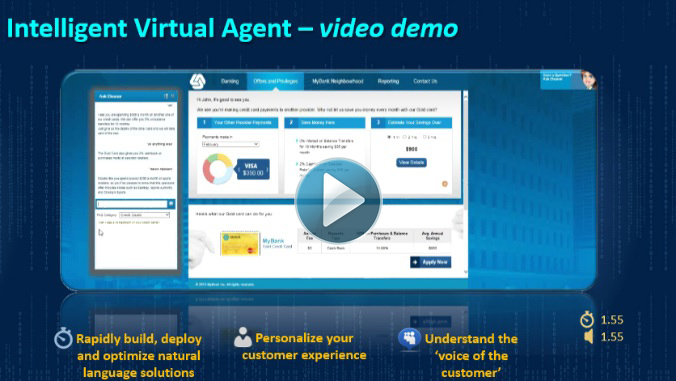

Though much is being written today about the range of possibilities, I take a pragmatic view on how to apply this technology to your call center to augment your cross-sell and upsell efforts. Let me walk you through a simple retail banking example to proactively engage your customers as they check their account balances or respond to a credit card offer. Importantly, this use case goes beyond just interactive voice response. It provides personalized, automated, and highly context-sensitive responses which are important in creating an intelligent “concierge-like experience” for making tradeoffs and decision making.

We at Mphasis have been working closely with a partner to vertically adapt the technology for banks, brokerage and insurance clients. Case in point, you go to a consumer bank to shop for a credit card. You’re interested in a Gold card. The IVA recognizes it’s you, identifies your pattern of purchasing, mortgage history, and record of purchasing travel insurance. The IVA looks at your entire profile as an existing customer and can quickly offer up a Platinum card an alternative that provides better travel insurance coverage and savings. You are presented with this info as an A/B offering and can select the best card to suit your needs. Furthermore, the choices are shown the context of your monthly spend patterns and the application form is pre-populated with your personal information.

So let’s summarize the benefits

- Branding

- Consistent identity, tone of voice, and image across all channels and languages

- Better consumer experience

- Intelligent profiling, personalization, education, and recommendations so prospects and customers can make more informed decision.

- CSats – No wait time, serve anywhere, from any device, streamlined response and lower resolution time lead to better CSat scores.

- Increasing business revenue and loyalty

- Better consumer experience leads to earned trust and better conversion (lower drop off). Intelligent recommendations may lead to more compelling and relevant upsell / cross-sell opportunities. Over time, customers come to learn that the interaction is from a trusted advisor, not a pushy salesperson.

- Increased revenues from cross-selling and upselling of related add-ons, replacements, and refills

- Higher retention and reorder

- Digital banking creates new opportunities to re-do (rethink) the entire engagement process which helps identify areas for improvement. This allows banks to become aware of “missed opportunities” and convert them to additional revenue. For example, many go online to reconfirm their account balance after payroll deposits. Once they see the balance and log off, an IVA can assess a customer’s daily balance, track his expenses and verify that this user has met the $5,000 minimum balance for last two years. With this info, the IVA could suggest that maybe the customer should open a CD or FD for higher interest without impacting his cash flow. If the customer is connected to his mortgage account, perhaps applying $5,000 would reduce the principal for next 40 months resulting in accelerating his mortgage payoff by two months.

- Reducing cost

- Given every interaction with the call center and in-person visit to bank cost money, digital banking can help pre-empt the user’s problems and possibly resolve them without interacting with a live agent.

- Intelligent handoff from IVA to a live agent can improve the latter’s efficiency by 20%+

- Improved “first contact” resolution rate can be up to 60%

- Reduction in contact/call center volumes can be up to 25%-35%

- Reduction in resolution times, when used in conjunction with live agents, can be up to 70%

So how long does this take? Typical time from deployment to when benefits start to be realized averages 14+ weeks

In summary, tradeoffs are thought through, and decisions are made. Just think about it. It’s a lot more than just Q&A. It’s not just looking up a database. It gets closer to a real human interaction, akin to working like a smart salesperson who can help you trade off a few variables to get closer to what is right for you. The IVA reacts to your context and changes things around in a “sense and respond” mode. And if there is a change in your tone, the IVA is astute enough to call a live agent as well! Talk about a little bit of self-awareness.

So why is this possible? NLP allows the experience to transform from a mere Q&A or even personalized engagement to one that brings together the multiple channels and creates a guided concierge experience. It ultimately leverages the content and design that serve as the foundation for all businesses and their prospects and customers alike.