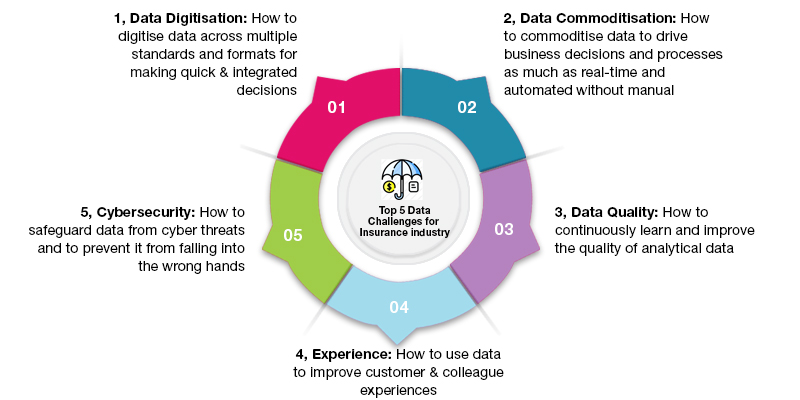

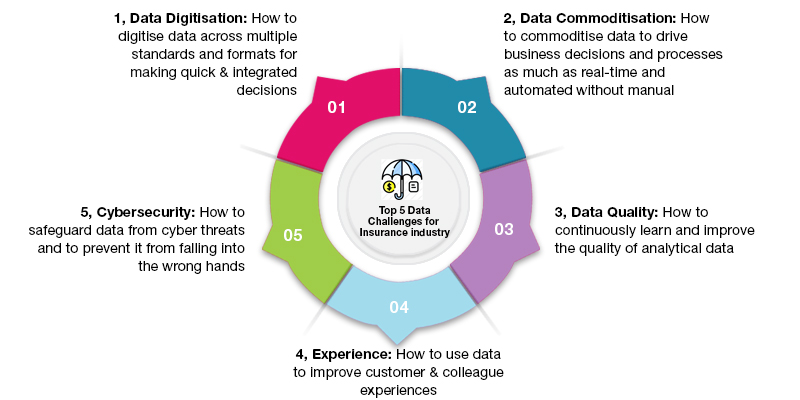

Data is the backbone of every industry. Data helps make better decisions about finding new customers, increasing customer retention, improving customer service, effectively managing marketing efforts, tracking social media interactions, and predicting sales trends in the industry. The Insurance industry, in particular, faces few challenges, which result in missed opportunities.

Top five data challenges for the insurance industry

Standards do not fully address challenges

There are standards like Accord and Basel that are good at standardising the regulatory format for exchanging data during the lifecycle. However, none of them addresses the aforementioned challenges effectively.

Challenges with standards and effective adoption

Complex and unique product definition and evolving market needs across different LOBs have led to challenges in adopting these standards. The core PAS system does not support compliance to these standards as part of their native design. It leads to additional time, cost, and effort for brokers and insurers to be compliant and realising benefits is deferred.

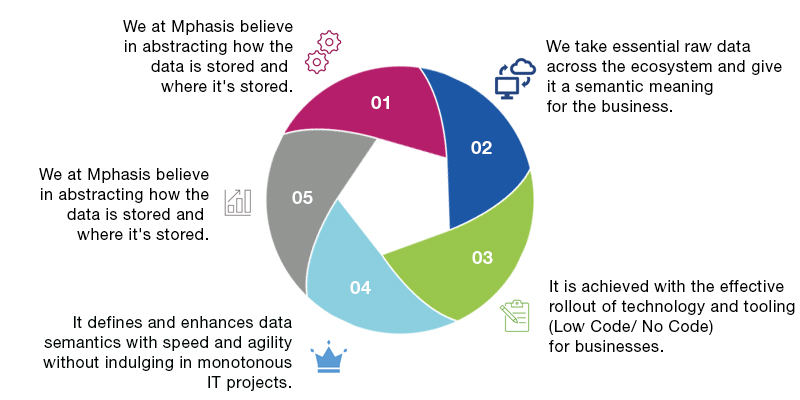

What role does Mphasis play here

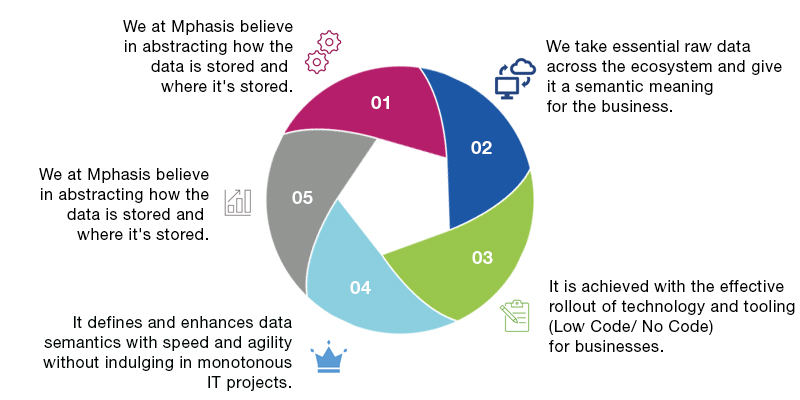

Customers have continued to invest in data lakes and warehouses over the last decade, effectively aggregating data. "Without semantics on top of those, it's impossible to get any value out of it. We think of a universal semantic layer as an abstraction layer."

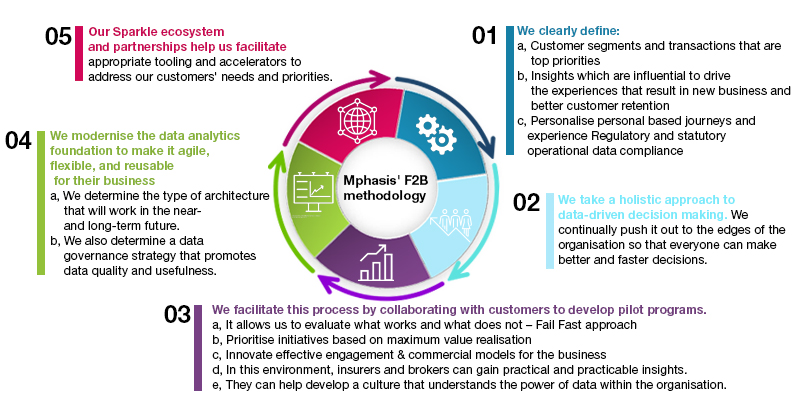

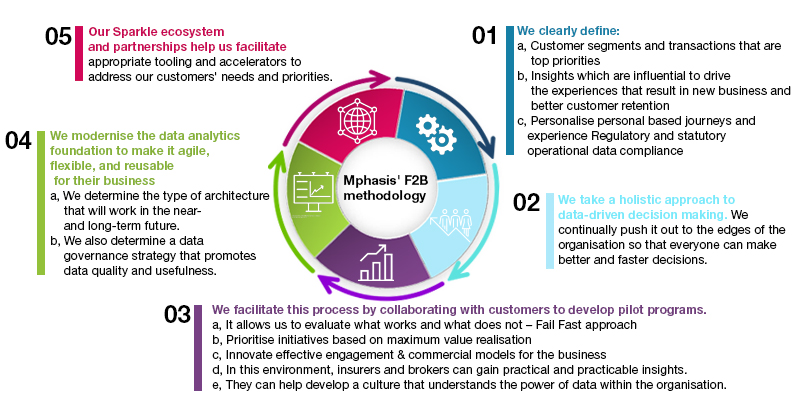

Mphasis' patented F2B methodology

We use our patented F2B methodology to minimise data movement and avoid creating multiple data copies throughout the enterprise. The universal semantic data layer modelling allows us to simplify and effectively leverage data to drive all decisions and processes and personalisation towards the consumer. We do all this with speed and agility.