NEXTOPS

A strategic partnership based on

domain, technology and operations expertise.

The unprecedented COVID19 crisis has created tremendous threat and uncertainty to business and people. At Mphasis Business Process Services, we are on a mission to bring back confidence in business operations. As organizations gear themselves to reboot and march forward, we are right by their side to bring back their confidence.

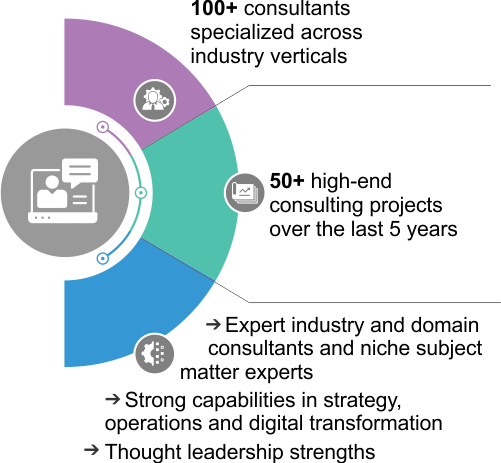

We design solutions custom-made to our clients’ objectives, budgets, and the pace of change required by them. Our blueprint-driven and proprietary consulting methodology ‘Define, Diagnose, Design and Deliver and Transform’ is strongly supported by focused toolkits.

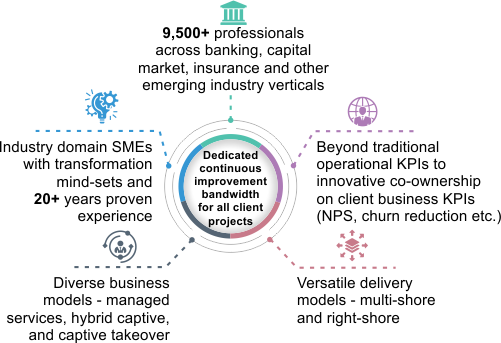

We deliver seamlessly efficient industry middle office services, back office operations and customer contact solutions – for highly regulated industries. Our new age transformation solutions bring the right blend of digital and emerging technologies – with the right and refined governance models.

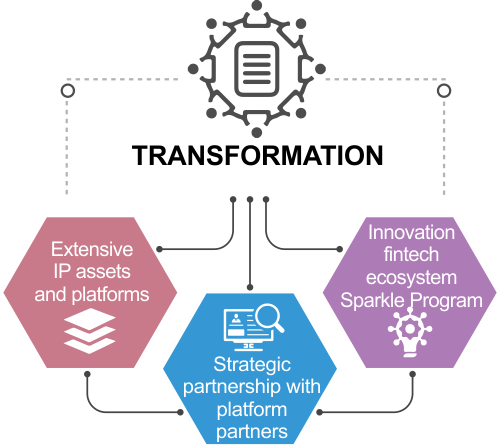

Our customized transformation solutions and services are powered by data, digital, cloud and next - gen technologies. We deploy the Mphasis Front2Back™ approach to enhance end customer experience without changing the core. Our seamless ‘information-to-insight’ journeys leverage data to understand customers intimately and deliver hyper-personalized experiences.

We understand that each organization has individual goals, challenges and outcomes they need to achieve. Our NextOps applies the power of our integrated ‘Tech & Ops’ to design solutions that meet specific needs and boost efficiency and customer experience. Be it integration and collaboration through business process automation, or insights-driven decisions through analytics, or enhanced productivity through cloud services, our digital transformation levers enhance end-customer experience and co-create value.