Services

A regional bank in the US that caters to clients with high wealth, offering personal banking, business banking, trust, and wealth management services and products.

The client wanted to modernize its operations, improve efficiency, and enhance the customer experience. It is a complex and time-consuming process involving many steps, including data mapping, data conversion, system integration, and testing.

BUSINESS CHALLENGES

The customer's core banking system is old and has been in use for 30 years. It has many issues, such as poor access to data, especially customer data, scalability, reliability, slow response time, daily balancing & reconciliation, item processing limitations, reporting capabilities, etc.

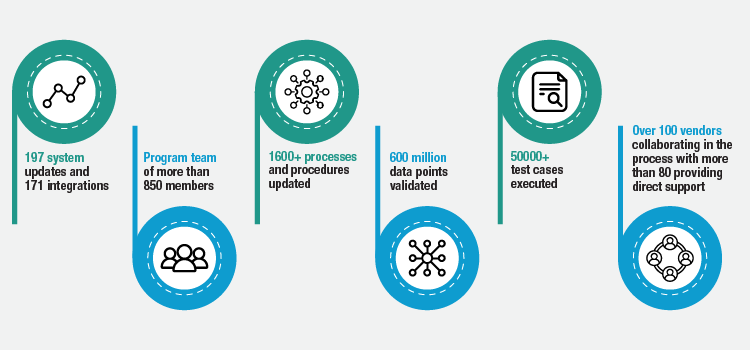

We embarked on a cross-functional and business-led effort to connect frontline, operations, and technology teams. Creating a detailed and purposeful implementation plan, we de-risked the conversion exercise through a phased implementation approach.

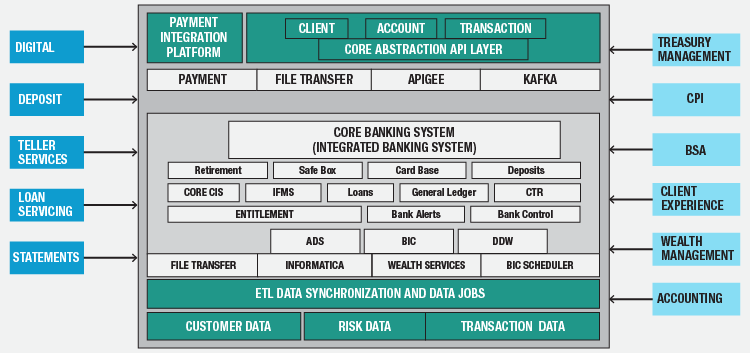

Our implementation strategy involved three major integration layers: a core abstraction API layer, a Core banking System Connect layer, and ETL data synchronization. These layers provided a central access point to the Core banking System, a layer of abstraction for internal systems to access core banking APIs, and a data design that synced the bank's data from the core for better analytics.

The new core banking software is a platform that can adapt to the future, enhance capacity, and integrate seamlessly. It would shorten the time-to-market and provide better client and employee experience, and it has an extra layer of API abstraction when connected to the new core from the bank's internal system.

Core Abstraction API layer

Core banking System Connect and Vendor Application Integrations

ETL Data Synchronization and Data Jobs

Mphasis provided recommendations for best practices and supported specialized technologies that helped businesses assess and mitigate risks involved in their overall program. Our commitment to delivering high-quality products and services that meet client expectations has resulted in several benefits.

Significant time savings for the client through the integration of multiple banking systems into one

Streamlined account servicing and opening, with real-time onboarding of new residential loans

A new teller system, with easy access to check images, signature cards and statements, and client profile views

Improved scale and enhanced client and employee experience

Quicker and more seamless integration of applications and features, enabling the bank to easily integrate future technology upgrades

Enhanced overall client services and the ability to offer new products and services to customers