Life Insurance Digital Agency (LIDA)

The intelligent human touch in the digital future of insurance

In a world that is irrevocably turning ‘digital first’, insurance agents need their individual digital workspaces and tools to create effective digital reach to their customers. Imagine if insurers could provide personalized digital presence for their agents with intelligent digital platforms and tools — which, in turn, can unleash business opportunities at scale, and accelerate the collaborative digital transformation of insurance.

Mphasis’ Life Insurance Digital Agency (LIDA) does exactly that. A single-tenant customizable digital workspace, it empowers agents working for insurance companies to administer, illustrate and sell Life and Annuity products in the digital realm. LIDA is a highly secure, cloud-based solution in AWS, which is augmented by data visualization and data intelligence to create sustainable digital growth and transformation.

LIDA enables agents in insurance companies to be digitally connected to their customers — existing and potential. It provides them powerful digital visibility and helps them become trusted partners to their customers through the following features:

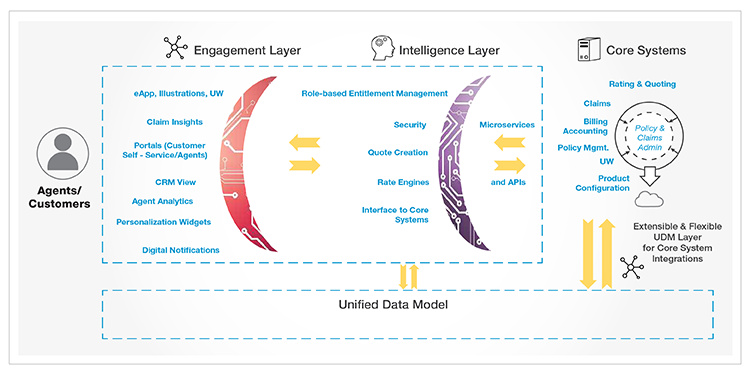

LIDA’s architecture comes with 3 distinct layers for engagement, intelligence and systems interface.

LIDA’s efficient and unified data model (UDM) allows the integration of the Policy Admin System with other functions within the carrier’s ecosystem. It is based on an event-driven continuous flow of events that synchronizes states across all systems — and is designed for extensibility, flexibility, and security. It operates on a role-based access model with delegated administration rights

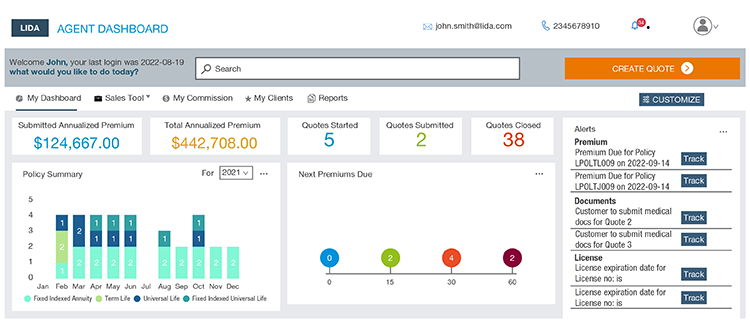

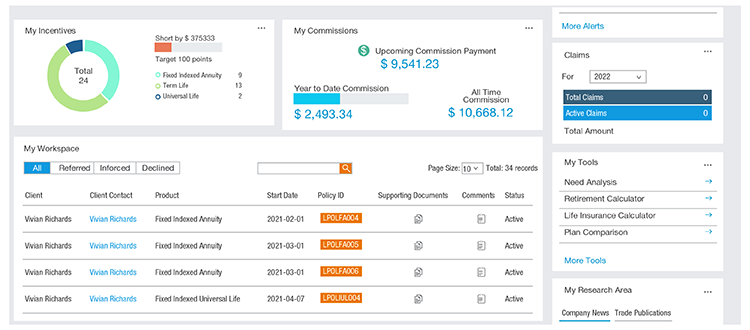

LIDA provides insurers and agents a comprehensive dashboard view and data visualization of the status of policies, quotes, claims, premiums, notifications, incentives, and commissions — plus, a holistic summary of quote statuses and policy details.

Agents can also personalize the menu and widgets featured on their dashboard for better insights-driven actions.

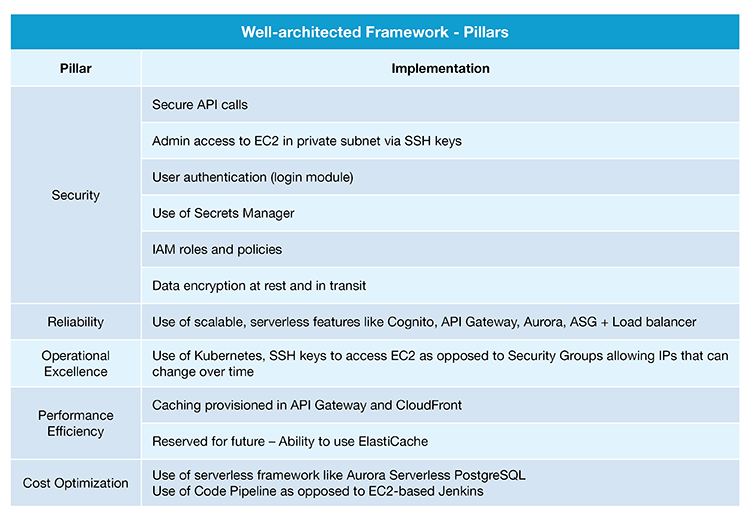

LIDA has been built on firm pillars of a well-architected framework, with the highest standards of security.

LIDA simplifies day-to-day business execution to enable agents improve customer experience,

overclock efficiency and accelerate ROI. Key outcomes include:

Enhanced business agility due to sharper insights

Improved operational effectiveness through reduced manual processes, and better utilization of resources

Superior customer experiences

Significant cost reduction - due to serverless architecture

More robust marketing strategies, enabling significantly higher ROI

Seamless scalability - with highest levels of quality and security

Simplified reports

High extensibility - ready for use by insurance agents, independent agents, brokers, and other intermediaries